Beyond ETFs - investing by you

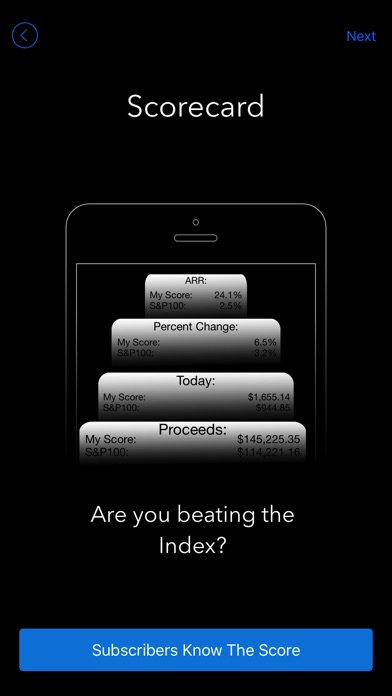

Beyond ETF Pro gives the two most important pieces of information an investor needs to know - what to buy, and when to sell. We do this in a way that leads the subscriber to beat the S&P100 ETF. We offer an instant scorecard to show how it all shakes out. This is a truly innovative, all-mobile and inexpensive way to manage investing by yourself.

Why the S&P100? The S&P100 stocks are the finest of all US companies. Theyre name-brands. Youve heard of (virtually) every one of them. Theyre not going away. Some have dividends, some dont. Each of them put billions (sometimes trillions) of dollars of investors capital to work, every day.

The trouble with any ETF is they hold ALL the stocks in their category. So, the S&P100 ETF, (OEF), holds the winner stocks in the S&P100, and at the same time, they hold the loser stocks in the S&P100.

Our subscribers beat the ETF by separating out the winners and only invest in those stocks, and avoid the losers. Thats a proven and winning way to invest.

Research has shown that companies whose stock prices have increased over the past 6-12 months are likely to continue to increase over the next 6-12 months, while those stock prices that have been declining over the past 6-12 months are likely to continue to decline over the next 6-12 months. Thats PRICE MOMENTUM.

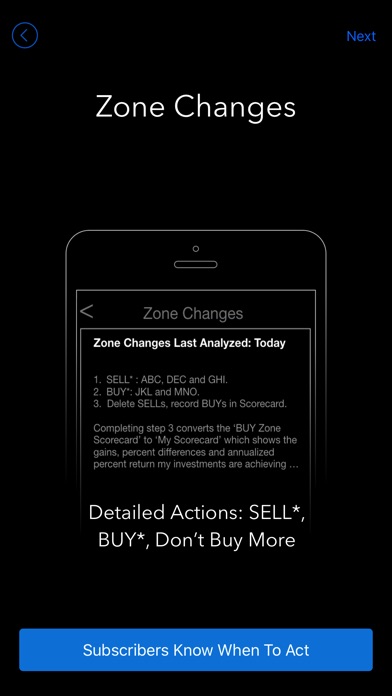

In Beyond ETF Pro, we use PRICE MOMENTUM to rank order each of the stock in the Index. We automatically apply the Brockmann Method to place each stock in the BUY* ZONE, the DONT BUY MORE ZONE and below the SELL* THRESHOLD, into the AVOID ZONE.

Every day, the Zone Changes report comes to the iPhone and iPad Beyond ETF Pro app and signals to subscribers what stock to buy (has high price momentum) and that its time to sell what other stock you own that have fallen into the Avoid Zone. Its not so much that a stock that enters the Avoid Zone (pass the Sell Threshold) is a loser, its just that there are at least 25 other, better opportunities to invest, each with higher Price Momentum, and 10 in particular that are at the top of the list.

Subscribers use Beyond ETFs to take the natural next step - your own, personally-managed and personally-controlled, Self-Directed Fund, composed of the best stocks in the S&P100 ETF. Thats what youd be subscribing to - a simple way to cut through the clutter of investing confusion and get focused on only a few high quality stocks. Beyond ETFs even supports fractional share ownership too. Lets beat the ETF, together. Download Beyond ETFs today.

ABOUT APPLE AUTO RENEW SUBSCRIPTIONS:

Some of the content in Beyond ETFs is free and available to all users. The best experience is through the subscription service. Beyond ETFs enables the In-App Purchase of auto renewable subscription services:

• S&P 100 ETF Monthly renew

• S&P 100 ETF Quarterly renew

• S&P 100 ETF Annual renew

Subscribers gain access to exclusive content such as daily updates to the BUY* zone, insights from frequent Zone Changes, details of the SELL* Threshold, personalized Scorecard and a 7-day FREE trial.

Subscriptions automatically renew unless auto-renew is turned off in iTunes account at least 24-hours before the end of the current subscription period. The payment method of your iTunes account will be charged the renewal fee 24 hours prior to the end of the current period at the price and frequency that you select. Confirming the subscription will cause your iTunes account to be charged.

End User License Agreement and Privacy Policy are only a tap away.

Disclaimer: Brockmann & Company are not a registered broker-dealer or investment adviser; consult your own investment adviser for any financial advice. Peter and Wilfred Brockmann may own some or all of the stocks discussed. There are always risks associated with owning stock including loss of capital and high, low or no returns.